mike.editor@midpush.com, updated 190409

For the past 30 years or so it has been a “custom”, not a requirement, for presidential candidates to release their tax returns. Presidential candidates are however required to file a “Personal Financial Disclosure” with the Federal Election Commission. Donald Trump has filed a Personal Financial Disclosure , but so far he has refused to reveal his tax returns that contain more detailed information.

House democrats, led by Nancy Pelosi, have stated they plan to request Trumps tax returns. One method is to use a little known section of the IRS, specifically IRS Section 6103(f)(1).

If you wanted to play tit-for-tat, on June 26, 2017, only 12 out of 530 senators and representatives had released their tax returns. But, you can’t fault the others, they are not required to. And neither is Trump.

For some, tax returns are a private matter.

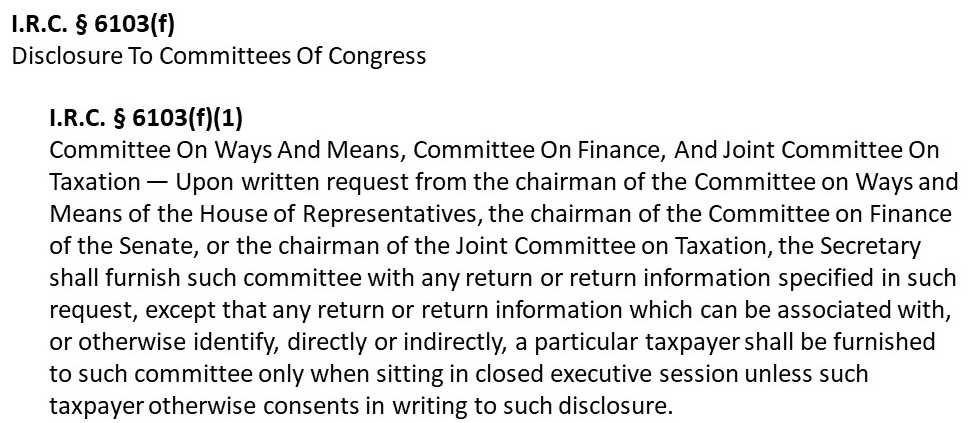

Section 6103(f)(1) reads in part.

Nominally this is an underutilized section of the IRS. It has never been used against a President and the Separation of Powers would certainly come into play. Meaning the Supreme Court might be asked to intervene. This could take a few years. And this provision provides some anonymity for the tax payer being reviewed.

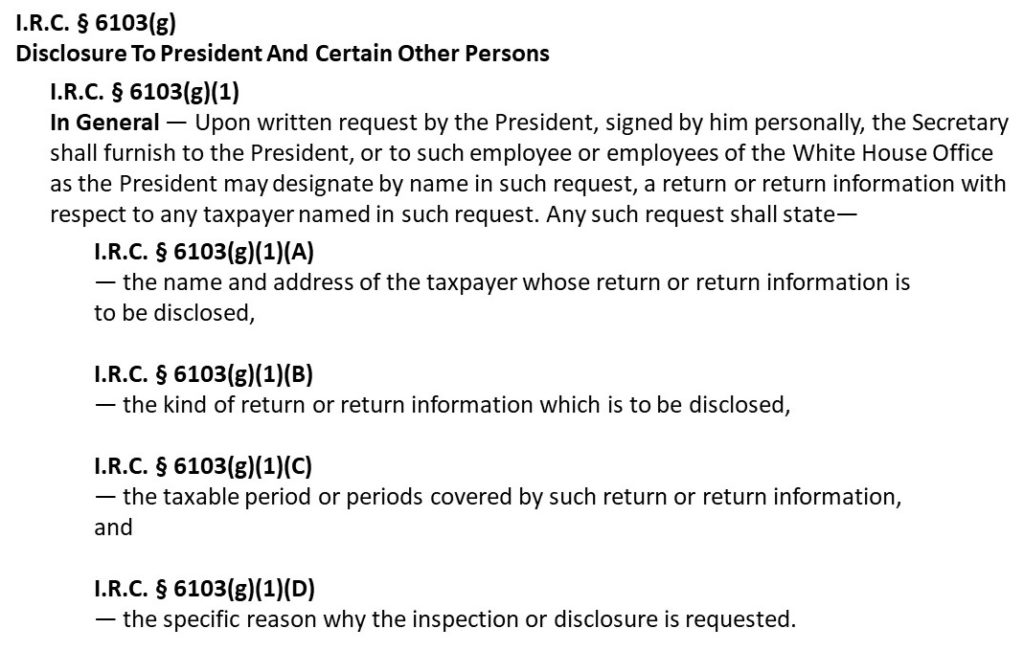

What could Trump do? Well, reading past 6103 (f), try IRS Section 6103 (g)…. It gives the President much broader powers than congress to pull anybody’s tax return.

This section gives the president very broad powers. He does not need a reason for these requests. He does have to eventually disclose who he has made requests for. But this would be after the fact.

Could Trump pull Nancy Pelosi and her husband, Paul Pelosi’s tax returns? And leak them, accidentally of course? Did AOC, working as a waitress disclose all of her tips? How many waiters have you known that disclose all of their tips? Did Dianne Feinstein and her husband, Richard Blum pay all their taxes? Or, George Sorros, who gave $400K to Kim Fox, might be interesting.

Where would it stop?

Public confidence in the tax system depends and relies on the belief that the IRS will protect taxpayers’ privacy. Most people have accepted Trump as not as clean as a whistle. His tax returns, have been reviewed and audited by the IRS for many years now. He probably attempts to make optimal use of the Tax Code, in his favor, as any smart American could do, and should.

Ideally, there should be a law that all candidates for public office should release their tax returns. But today, there is no such law.

In a letter to the Treasury Department’s legal office, one of Trump Attorneys wrote:

- If the IRS acquiesces to Chairman Neal’s request, it would set a dangerous precedent. As Secretary Mnuchin recently told Congress, he is “not aware that there has ever been a request for an elected official’s tax returns.” For good reason. It would be a gross abuse of power for the majority party to use tax returns as a weapon to attack, harass, and intimidate their political opponents. Once this Pandora’s box is opened, the ensuing tit-for-tat will do lasting damage to our nation.

- Can the Chairman request the returns of his primary opponents? His general-election opponents? Judges who are hearing his case? The potential abuses would not be limited to Congress, as the President has even greater authority than Congress to obtain individuals’ tax returns. 26 U.S.C. §6103(g). Congressional Democrats would surely balk if the shoe was on the other foot and the President was requesting their tax returns. After all, nearly 90% of them have insisted on keeping their tax returns private, including Speaker Pelosi, Senator Schumer, Representative Nadler, Representative Schiff, and Representative Neal himself.

In November 2013, Senate Democrats led by Harry Reid used the nuclear option to eliminate the 60-vote rule on executive branch nominations and federal judicial appointments. This opened a new frontier in politics.

Will Nancy Pelosi begin a new era herself?

Trump on leaving office, may, just leak tax returns, by accident. I wouldn’t put it past him.

Democrats should concentrate on legislation. Of course they have to work with the president. What have they passed in the last 3 months, that is now law?

Or we can wait another 21 months to see if this scenario changes. Remember the house must pass a bill, then the senate must also pass it, and unless they have veto proof majority in both the house and senate, the presidents signature is required.