mike.editor@midpush.com, originally published 190427, updated 190427

In the 2016 presidential race Bernie Sanders announced that he thought a college education should be free. This is in keeping with his leadership via compassion and emotion viewpoint.

In the 2020 presidential campaign, Elizabeth Warren, in her race to best Bernie regarding compassion and emotion, has one upped Bernie and come up with a platform that emphasizes throwing out a students prior loan commitments and going forward to make college as free as possible.

Sticking my neck out, if I was a candidate here is what I would do:

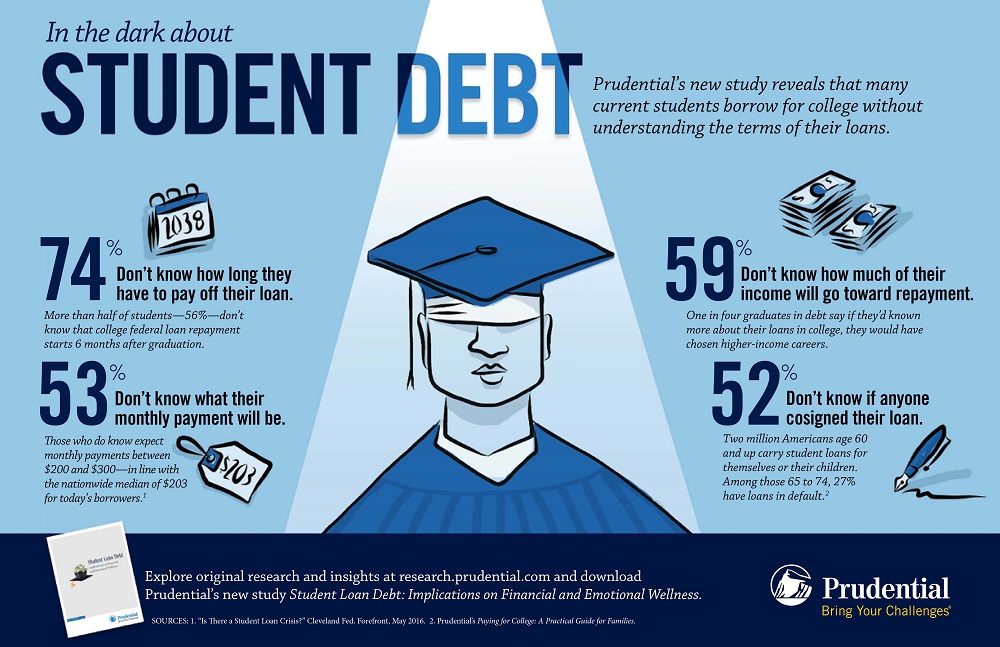

- Make High School Graduation contingent on understanding how Interest accrues and why you need to make more then the interest payment to pay the loan off in a timely manner. Too many students are clueless here….

- Demand that colleges, public, private, & for profit, publish statistics on graduate employment statistics and income received by graduates of each of their degree programs. Students need this data to make informed decisions. Doing this would also help colleges offer more pertinent degree programs based on the economy.

- Change the interest rate charged for these loans to be indexed slightly, say 2.5 points, above the 10 year treasury yield. Today, April 26, 2019, that would be 5%. The key point is given these loans are so hard to get rid of, a higher interest rate should be un-necessary.

- Push community colleges more by lowering their costs. In a number of states they are virtually free, (except for books). Two years at a community college with a transfer to a 4 year degree lowers the overall cost.

- Schools that accept federal student loan monies should publish statistics on teacher, maintenance, and administrator cost ratios. Too many state public schools started with good intentions, but now pay very high salaries for administrative work. The students and the taxpayer foot the bill.

Students need to understand that if they want to get an Art History major, and a number of the recent year graduates from their prospective college are working Docent jobs paying $28K a year. They most likely should not borrow $100K to fund their education. Conversely if the recent graduates from an engineering degree are making 120K after two years, borrowing $100K might be a sound investment.

Students over the age of 18 are adults, they need to be provided information to make informed decisions.

Elizabeth Warren’s Plan Highlights

- Estimated cost of her plan over 10 years, $1.25T, T=trillion

- Wipe out, ie pay off, existing loans for up to $50K. Up to 42 million citizens could benefit from this proposal. The pay offs would phase out for higher earners.

- Expand Pell-Grants for non-tuition expenses.

- Assist historically black colleges.

- Questions that are unanswered are:

- Effectively debt relief is income, would these payoffs be taxable by the IRS and states?

- How are students debts handled going forward?

- What about students who didn’t finish college?

- This plan would likely increase the number of students attending college, either more colleges are needed, or higher prices will result from increased competition.

Down the road, with an increased student loans and or grants, colleges would be freeer to raise prices higher allowing them to pay more and hire additional staff. This behavior is explained by the fundamental economic demand curve.

What prompted me to write this was listening to a KQED radio program, Forum. ANatalia Abrams from an organization studentdebtcrisis.org was on. Her key points are:

- Student Loan Debt is not the students fault.

- Education used to be free, and still should be. She believes free education will “collectively” help everyone.

- She is excited about Elizabeth Warren changing the world.

- She describes a number of stories, documented here. A number of these cases appear to be people who have not made interest payments, and yet seem puzzled their loan balance has gone up. Education loans and yet they don’t seem to understand credit, loans, and such. They need more education….

- Students and their parents are not responsible for choosing colleges with tuition way beyond their means or ability to afford. Buying college is like buying a car or a house — you do the research and purchase what you can afford.

- She believes people should go to the school of their choice. Regardless of cost. And the public should pay for it.

- She does not believe there should be a ROI (Return On Investment) regarding their choice of study.